Strong quarterly result for Feintool.

The ongoing positive market environment in combination with the strong positioning on the market helped the company achieve a successful first quarter in 2018. Group-wide, the Feintool Group achieved net sales of CHF 161.3 million, signifying growth in the reporting currency of 11.2%. Adjusted for currency effects, this equates to an increase of 8.8%. The effect of last year’s acquisition in China amounted to 2.1%.

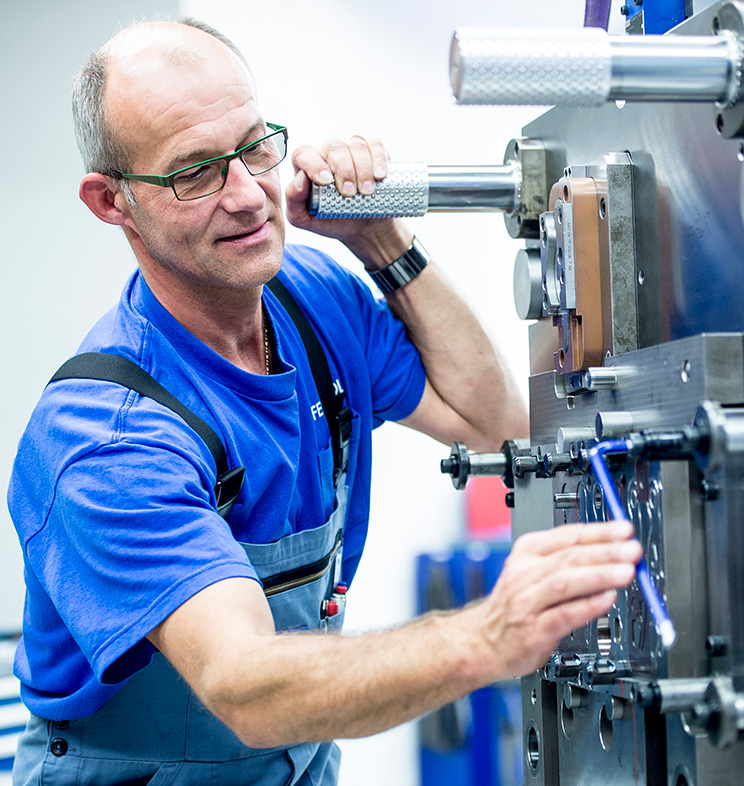

Business in the System Parts segment, with the high-volume production of sophisticated precision components, increased again. The segment was able to hold its ground in a difficult market environment. Net sales rose here by 9.4% to CHF 145.0 million, which, adjusted for currency effects, equates to an increase of 6.7%. The forming plant acquired in China contributed 2.3% to this growth. While business in Asia and Europe increased significantly, the American business saw a fall in net sales. The press and systems business in the Fineblanking Technology segment, on the other hand, the first quarter of 2018 saw a welcome visible upturn in net sales. Feintool recorded an increase in net sales of 31.9% or, adjusted for currency effects, 32.1% to CHF 22.6 million.

Rise in order entry in capital goods business – good order backlog

The Order entry in the Fineblanking Technology segment also showed a positive result, rising by 9.1% to CHF 29.3 million. The order backlog also increased by 18.2% to a high CHF 53.0 million. The extent of the order backlog in the Fineblanking Technology capital goods business is now over eight months.

Expected releases in the high-volume parts segment achieve record values again

The expected releases for the next six months mark a new record value in Feintool’s company history, rising by 22.1% to CHF 289.6 million. However, there has been increased volatility in this leading indicator of late.

Extensive new orders gained

In Asia, Feintool received various orders from renowned customers, which in future will generate annual net sales of around CHF 30 million. As a result, Asia is continuing to gain in significance in the long term as a growth market.

Confident outlook

For the 2018 financial year, we expect to continue our positive business development despite a market environment characterized by political uncertainties. Overall, we expect net sales of CHF 630 to 650 million and an EBIT margin of 7.5 to 8%.

The financial key figures at a glance

| 3/31/2018 in CHF million |

3/31/2017 in CHF million |

Change in % | Change adjusted for currency effects in % | |

|---|---|---|---|---|

| Consolidated net sales Feintool Group | 161.3 | 145.0 | 11.2 | 8.8 |

| Fineblanking Technology segment | 22.6 | 17.1 | 31.9 | 32.1 |

| System Parts segment | 145.0 | 132.5 | 9.4 | 6.7 |

| Orders received – investment goods business | ||||

| Fineblanking Technology segment | 29.3 | 26.9 | 9.1 | 9.3 |

| Order backlog – investment goods | ||||

| Fineblanking Technology segment | 53.0 | 44.8 | 18.2 | 18.9 |

| Expected releases – high-volume parts segment | ||||

| System Parts segment | 289.6 | 237.1 | 22.1 | 17.9 |