Feintool posts renewed increase in sales.

Organic sales growth

In 2015, growth in the global automotive industry persisted worldwide. Feintool benefited from the positive conditions in the sector. By gaining market share, moreover, it grew faster than the market in all relevant regions.

In this environment, the Feintool Group generated sales of CHF 508.9 million in the 2015 financial year, which corresponds to an increase of 1.1%. On a currency-adjusted basis, the company recorded organic growth of 4.4%.

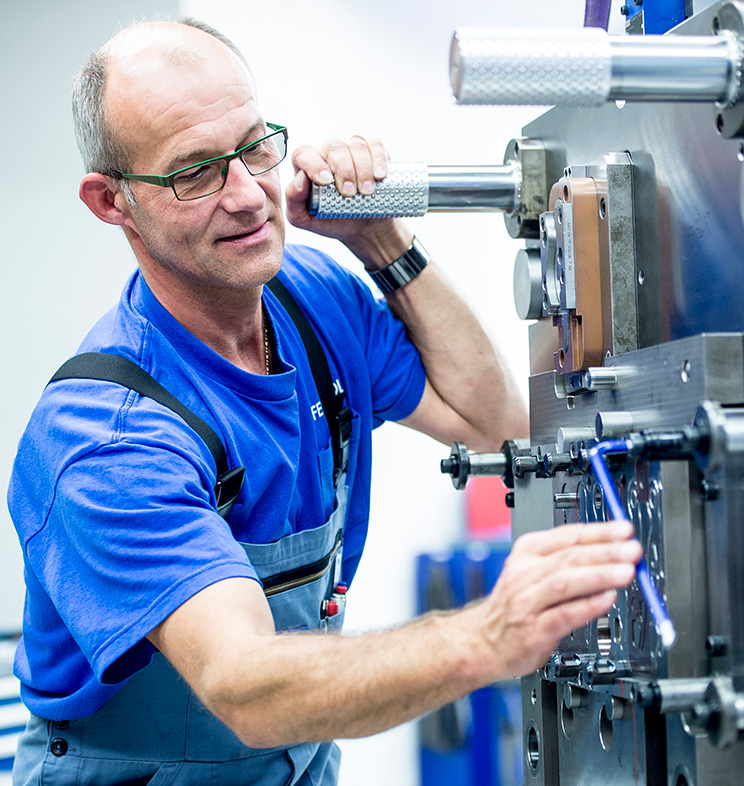

Among the business units, the largest share of sales was generated by the System Parts segment, in which Feintool is a global player in the high-volume manufacture of precision fineblanking and forming components. During the year under review, the segment grew by 8.2% in local currency to CHF 438 million and accounted for 86.1% of consolidated sales. The growth is mainly attributable to the increased volume of sales of new products in Europe and the United States.

Sales at the Fineblanking Technology segment, in which Feintool offers end-to-end technological solutions for fineblanking, came in at CHF 87.8 million. The year-on-year decline of 10.7% is attributable on the one hand to lower sales prices for currency-related reasons (invoicing in Europe is predominantly in euros) and, on the other hand, to client-side restraint due to market uncertainties. Sales of presses and tools to the System Parts segment rose slightly.

Operating profit down slightly due to exchange rates

In the year under review, all segments and regions once again made a positive contribution to operating profit. The Feintool Group reported operating profit of CHF 32.9 million – a decrease of 6.4%. Factoring out the negative impact of the dramatically stronger Swiss franc, operating profit would have risen by 2.8%. In operating terms, the EBIT margin thus came to 6.5%.

The System Parts segment reported EBIT of CHF 35.8 million and an EBIT margin of 8.2%. In high-volume parts manufacturing, the result was driven by a combination of good capacity utilization at our production sites and numerous efficiency-boosting measures. In addition, blanket orders secured in previous years made their first contribution to results. Although the German locations were largely able to compensate for the negative currency impact, operating profit in Europe declined, as the Swiss production site sells 95% of its products in the eurozone area. At the same time, around 50% of costs are incurred in Swiss francs, which inevitably erodes margins. Moreover, significant additional expenditure was generated by the concurrent launch of numerous products, preparations for the outsourcing of certain products to an acquired production site in Germany, and the increase in value creation achieved through installation of a heat treatment plant.

In the capital goods business of the Fineblanking Technology segment, Feintool reported operating profit of CHF 4.6 million. Here the margin saw a year-on-year decline to 5.2%. The primary driver of this development was the decline in sales. Research and development expenditure was intentionally increased slightly.

Net income slightly lower due to higher tax burden

Overall, Feintool generated net income of CHF 20.1 million, corresponding to a margin of 3.9%. In addition to the slightly lower operating result, the higher tax rate also had a negative impact on net income.

Measures for the Swiss locations on track

In recent years, Feintool has systematically driven forward its strategy of manufacturing in the various markets and currency areas in which it operates. 85% of sales are generated outside Switzerland. The Swiss market contributes just 2% to sales.

Despite this strategy, the strong appreciation of the Swiss franc resulted in a significant decline in margins at the Swiss production sites. At the Lyss (Switzerland) based parts production company, the strategic realignment involves an increased focus on speciality products. For this, Feintool has invested more than CHF 10 million on enhancing its value chain. The associated outsourcing of certain product groups to the new German production site is under way, and will yield its first results in 2016.

The extended working hours introduced in this context on 1 February 2015 partially alleviated the negative currency effect. The aim is to reverse this exceptional measure as soon as possible.

Numerous orders and expected releases

At the beginning of the financial year, expected releases on contracts with our clients in the System Parts segment amount to CHF 209.6 million. This is virtually unchanged from the previous year even though the currency situation has changed dramatically over the last 12 months.

Incoming orders from third parties in the Fineblanking Technology segment declined by 11% to CHF 77.2 million. The orders backlog grew by 9.4% to CHF 36.0 million, equivalent to around eight months’ work for the long-term press and tool business.

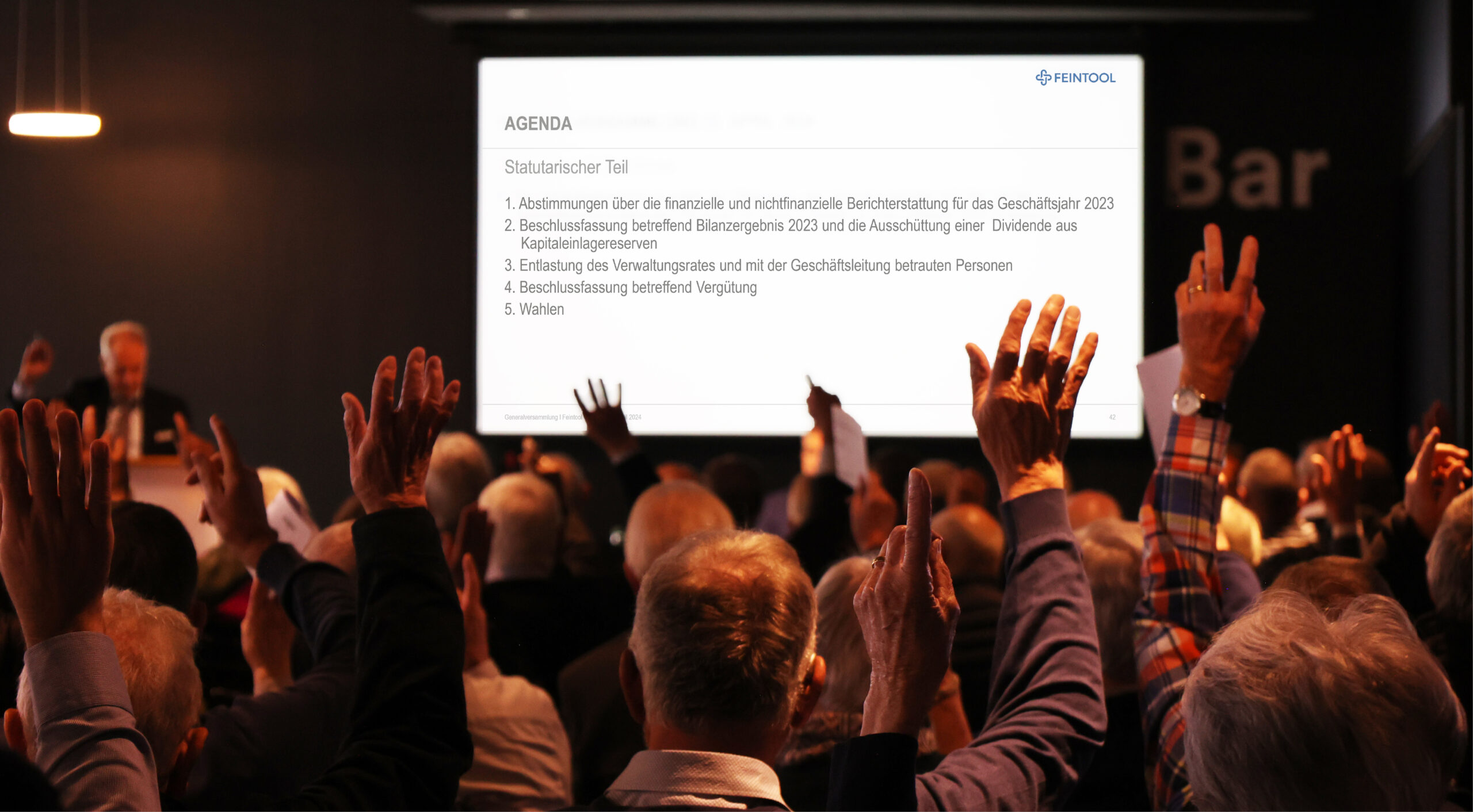

Unchanged dividend payment planned

Given the current performance of the Feintool Group and its stable financial position, the Board of Directors has decided to propose to the Annual General Meeting on 19 April 2016 an unchanged dividend from capital contribution reserves of CHF 1.50 per Feintool share.

Feintool looking to seize market opportunities

With a view to exploiting rapidly any market opportunities that present themselves, Feintool’s Board of Directors will propose to the Annual General Meeting on 19 April 2016 the creation of authorized capital amounting to 600,000 shares, equivalent to 13.4% of current share capital, with the possible exclusion of subscription rights for existing shareholders.

Board of Directors enlarged

Furthermore, the Board of Directors will propose to the Annual General Meeting the election of an additional board member, Dr. Rolf-Dieter Kempis, Partner at the Theron Advisory Group, for a term of office of one year.

Outlook essentially positive

Feintool is expecting business performance to be positive in 2016 – but is also expecting a stagnating market environment. This year we anticipate sales growth of 5% to around CHF 530 million and an EBIT margin of approx. 7%. This will be driven by an expansion of production capacity, the development of further innovations tailored to market requirements, and projects aimed at optimizing all processes.

Key financial figures in Brief

| FY 2015

in CHF m |

FY 2014

in CHF m |

Change in % | |

|---|---|---|---|

| Net sales of the Feintool Group | 508.9 |

503.4 |

1.1 |

| Fineblanking Technology segment | 87.8 | 98.3 | -10.7 |

| System Parts segment | 438.0 | 420.0 | 4.3 |

| Earnings before interest, tax, depreciation and amortization (EBITDA) | 61.4 |

62.9 |

-2.4 |

| Operating Profit (EBIT) |

32.9 |

35.1 |

-6.4 |

| Fineblanking Technology segment | 4.6 | 6.6 | -31.1 |

| System Parts segment | 35.8 | 35.0 | 2.3 |

| Net income |

20.1 |

24.6 |

-18.5 |

| Total assets | 426.9 | 427.4 | -0.1 |

| Shareholders’ equity | 207.9 | 202.9 | 2.5 |

| Net debt |

11.1 |

9.3 |

19.4 |

| Expected Releases – high-volume parts manufacturing (System parts Segment) |

209.6 | 213.9 | -2.0 |

| Orders received – third parties (investment goods) (Fineblanking Technology Segment) |

77.2 | 86.7 | -11.0 |

| Orders backlog – third parties (Investment goods) (Fineblanking Technology Segment) |

36.0 | 32.9 | 9.4 |

| Employees | 2049 | 1987 | 3.1 |

| Apprentices | 75 | 82 | -8.5 |