Feintool increases net sales and profits.

The technology company can once again look back on a positive financial year: Net sales grew by 11 percent year on year in 2018 to reach CHF 680 million, while operating earnings (EBIT) amount to CHF 48 million. The operating margin stands at 7 percent. The group’s net result increased by 9.9 percent to more than CHF 30 million.

Organic increase in sales

The global automotive industry continued to grow in 2018 up to and including the third quarter. Feintool benefited from this positive industry trend and grew, despite challenging general conditions, outpacing the market in every relevant region.

The Feintool Group generated net sales of CHF 679.6 million in the 2018 financial year, which corresponds to an increase of 11.0%. Adjusted for currency and acquisition effects, the company achieved growth of 6.1%.

Of the corporate segments, System Parts, in which Feintool is globally active with the high-volume production of precision fineblanked, formed and stamped components, accounted for the largest share of sales. In the year under review, the segment grew in local currency by 5.6% to CHF 586.9 million, thus generating 86.0% of the consolidated sales. This increase is primarily due to greater sales volumes of new products in Europe year on year, as well as the acquisition of the forming plant in China and those operating in the field of electro sheet stamping.

In the Fineblanking Technology segment, in which Feintool provides comprehensive technological solutions for fineblanking, net sales totaled CHF 106.9 million, which equates to a significant increase of 16.9%. Business with fineblanking presses and tools has developed very positively.

EBIT rises again

All segments and regions made a positive contribution to the operating profit (EBIT) this year as well. The Feintool Group generated operating profit of CHF 47.5 million, which corresponds to a slight increase of 1.2% in local currency.

The operating business achieved an EBIT margin of 7.0%.

The System Parts segment achieved an EBIT of CHF 43.5 million and an EBIT margin of 7.4%. The decline in sales in the fourth quarter led to under-utilization of production at certain plants. Moreover, some plants are preparing for new products, which resulted in considerable ramp-up costs.

In the Fineblanking Technology segment’s investment goods business, Feintool generated an EBIT of CHF 9.8 million. The margin increased significantly year on year to 9.2%. The main reason for this development is the considerably higher net sales. Research expenses were similar to the previous year, coming in at CHF 4.8 million. Activities in this area are continually being intensified as an investment in the future.

Group result has risen

Feintool generated a consolidated Group result of CHF 30.5 million overall, which equates to a margin of 4.5%.

Numerous orders and expected releases

Expected releases among our customers in the high-volume parts segment amount to CHF 286.1 million over the next six months. Nominations for new products to the tune of CHF 55 million promise positive development of the high-volume parts segment in the medium term.

Incoming orders in the Fineblanking Technology segment rose again – even compared to the high level of last year – by 1.7% to reach CHF 102.3 million, of which CHF 14.6 million were internal orders coming from the System Parts segment and CHF 87.7 million came from third parties. The order backlog fell by 17.9% to CHF 37.3 million. The order inventory amounts to six to eight months for the long-term press business. As a result, press manufacturing is in a good starting position for the 2019 financial year.

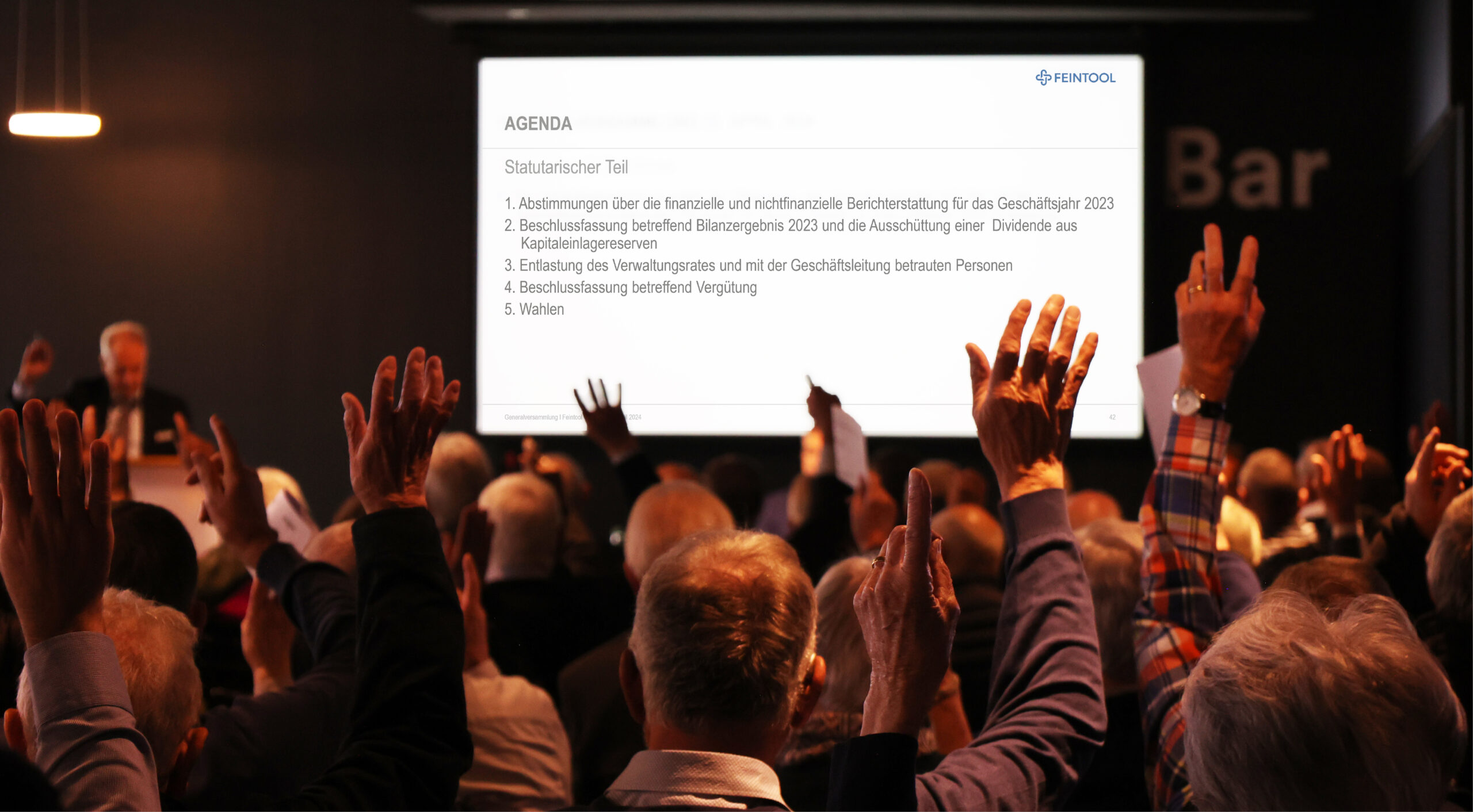

Dividend distribution as planned in the previous year

In light of this annual result as well as the consistent payout policy, the Board of Directors will propose to the General Meeting on 30 April 2019, that it pay a dividend of CHF 2.00 per Feintool share from capital contributions.

Investments in increasing market shares

Business with the newly integrated electro sheet stamping technology has likewise developed encouragingly. Due to the long-term rising demand for efficient electric motors, especially in the field of mobility, the investment in the acquisition of Stanz- und LaserTechnik Jessen GmbH has proven to be the right move. In combination with the fineblanking and forming technologies, the group is very well positioned and ready to gain further market shares. After completing the first electro sheet stamping orders in Europe in 2019, the new technology will subsequently be rolled out in Asia and North America to supply the growth market of electromobility worldwide.

Outlook

Feintool expects the automotive market to grow in the medium and long term. Due to economic and political uncertainties, there is a possibility of a short-term drop in sales in individual markets. Under these general conditions, Feintool expects net sales of between CHF 690 and 730 million for the 2019 financial year, as well as a slightly higher EBIT than in 2018.

Overview of key financial indicators

All the information on the Feintool annual results for 2018 can be found in the 2018 Annual Report, which is available online.