Gratifying annual results – Green light for the Kienle + Spiess acquisition.

Ad hoc announcement pursuant to section 53 of the Swiss stock

Despite the very challenging market environment, Feintool closed the 2021 financial year with strong sales growth and an EBIT margin of about six percent. Sales for the full year rose by 19.5 % to CHF 588.1 million; EBIT reached CHF 33.9 million. With the acquisition of Kienle + Spiess GmbH, Feintool has set an important course for the future.

Green light for the acquisition of Kienle + Spiess GmbH

The antitrust authorities have given their approval for the purchase of Kienle + Spiess GmbH by the Feintool Group. The closing of the purchase agreement signed on December 6, 2021 took effect at midnight on February 28, 2022.

With the acquisition of the European Kienle + Spiess, Feintool is decisively strengthening its market position in the field of electrification as next-generation technology. Kienle + Spiess supplies rotors and stators for highly efficient electric drive systems. Rotors and stators form the power-generating core components of electric motors or generators. Kienle + Spiess is one of the leading suppliers in this field. With this acquisition, Feintool is significantly expanding its electrolamination stamping business and positioning itself as one of Europe’s leading manufacturers of motor cores for battery electric vehicles (BEV) and hybrids (HEV), industrial drive systems and regenerative energies.

Financial year marked by numerous challenges

The demanding situation marked by uncertainties and the associated macroeconomic developments, which were difficult to forecast, continued to be dominating factors in 2021. The corona-induced slump in demand was followed by a rapid revival of economic activity at the beginning of the year. Towards the middle of the year, the upswing stalled. Supply bottlenecks, price increases, and the effects of the pandemic meant that global economic growth forecasts had to be revised.

In the automotive industry, which is of major importance to Feintool, supply could no longer keep pace with demand. The industry was confronted with a global shortage of computer chips as well as with very high steel prices. This led to a significant drop in sales in the second half of the year, and millions of vehicles could not be finished and sold.

Despite these extremely challenging conditions, the Feintool Group performed well and closed the 2021 financial year with significant growth in all relevant key figures. The volume growth led to better capacity utilization at the plants and thus to higher profitability. Our segments and regions are well and flexibly positioned and generated satisfying results despite the constant fluctuations in business. Performance was characterized by regional and technological differences.

Significantly higher sales

Consolidated Group sales increased by 19.5% to CHF 588.1 million. Half of this was volume growth while the other half was the result of higher material prices and the associated higher sales prices. While the Fineblanking Technology segment recorded a 14.7 % decline in sales to CHF 37.7 million in the press and service business, the System Parts segment with its high-volume parts business – adjusted for currency effects – increased sales by 20.6% to CHF 559.8 million compared to the same period of the previous year.

The Feintool Group generated earnings before interest and taxes (EBIT) of CHF 33.9 million, corresponding to an EBIT margin of 5.8%. This includes negative one-off effects amounting to CHF 0.5 million. Without these one-off effects the operating result amounted to CHF 34.4 million, which corresponds to an EBIT margin of 5.9%.

The operating earnings of the System Parts segment increased to CHF 46.2 million, corresponding to an operating margin of 8.3%. The Fineblanking Technology segment suffered an operating loss due to the market’s continued reluctance to invest.

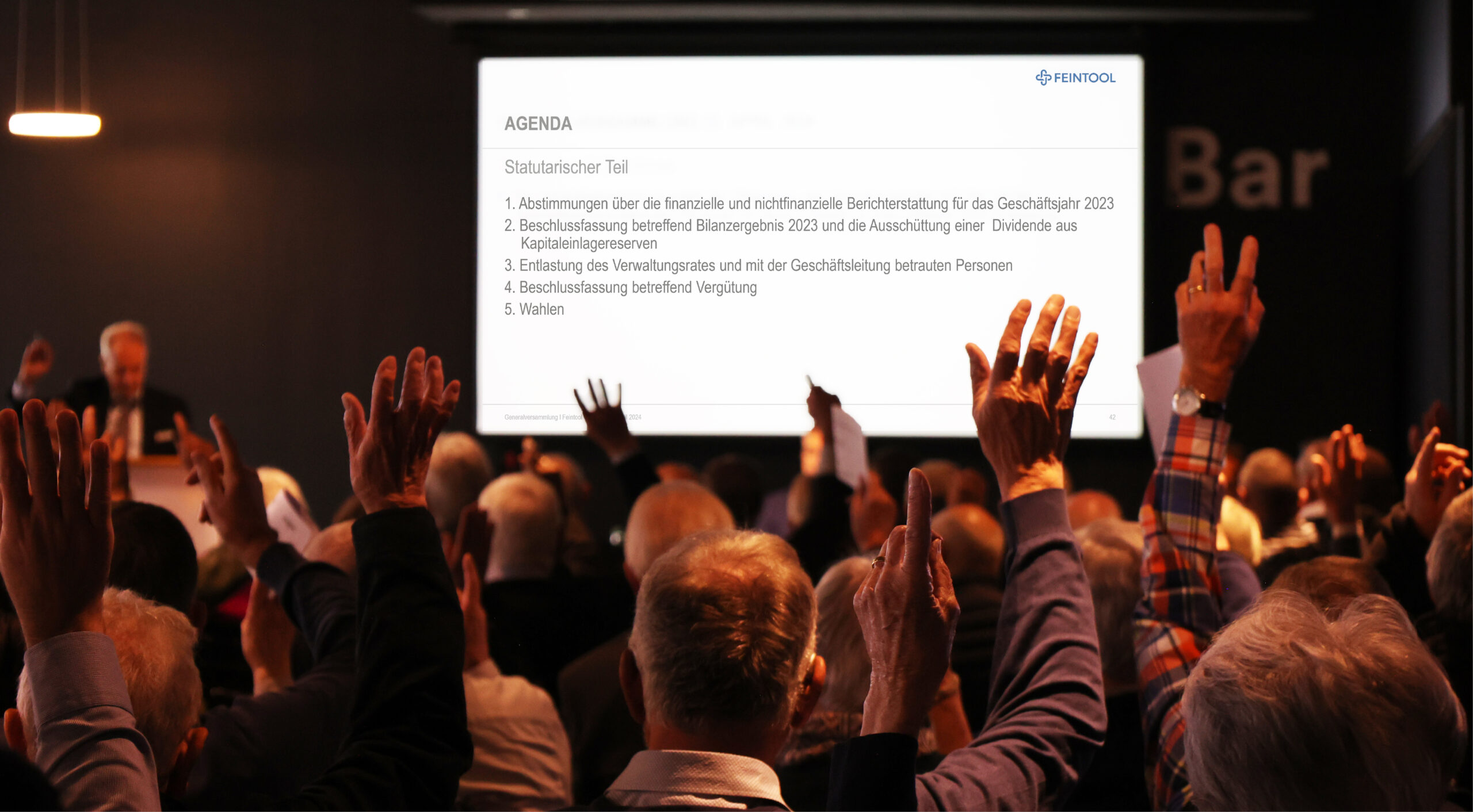

All in all, taking into consideration the one-off effects, a net income of CHF19.2 million was generated, which corresponds to a return on sales in this period of 3.3%. As a result, a dividend payout of CHF 1 per share will be proposed to the shareholders at the Annual General Meeting on April 28, 2022.

Key figures on the equity offering

To refinance the bridge loan for the acquisition of Kienle + Spiess GmbH and the injection of funds for future investments, Feintool is planning a capital increase in the amount of CHF 200 million. At the time of this press release, the issue price is not yet known. Subscription rights are to be granted in full and trading in subscription rights is planned. UBS is acting as Global Coordinator and as a Joint Bookrunner with Zürcher Kantonalbank.

Sustainability goals set

A responsible approach to the environment is a cornerstone of Feintool’s corporate philosophy. In the year under review, Group Management set targets for sustainable development in the areas of the environment, innovation and human resources. For example, CO2 emissions (Scope 1 and 2) are to be reduced by 50 % by 2030 and the share of turnover accounted for by CO2-friendly applications is to be increased to 70 %. For employees, the company aims to achieve successful implementation of the global talent management program in 2022 and, as an employer, to build up a talent pool to promote young talent. A full reporting will be provided in the Sustainability Report 2021, which will be published at the end of April 2022.

Optimistic about the future

The challenges that contributed to the global chip crisis will continue to affect Feintool in 2022. The company continues to prepare for short-term, pandemic-related challenges that vary from region to region. These include bottlenecks in supply chains or developments in raw material and energy prices. According to forecasts, the supply bottlenecks will only gradually ease, and economic activity is expected to return to normal capacity utilization from the second quarter onwards. The effects of pent-up demand, which in turn will lead to temporary overloads, must be expected.

Feintool is optimistic about the future. Despite all the challenges, the international automotive industry remains a growth market for which technological expertise and innovative strength are crucial. Feintool will remain on course for success thanks to its clear transformation strategy.

Guidance: Significant increase in sales with slightly lower profitability

Feintool expects the recovery to continue in the fiscal year 2022. However, uncertainties in the global supply chains will also persist. In particular, the semiconductor shortage relevant to the automotive industry, as well as uncertainty in raw material and energy prices will continue to weigh on our industry.

Barring any unforeseen circumstances, Feintool expects to generate sales of over CHF 800 million and an EBIT margin of over 3% for the fiscal year 2022.

All the information on the Feintool annual results of 2021 can be found in the 2021 Annual Report, which is available online.